How to do your Curve Finance (CRV) taxes with Koinly

Whatever your Curve Finance transactions, you'll need to figure out if you owe tax on them. Koinly can help. It's this simple:

Sign up to Koinly and choose your country and currency.

Connect the wallets you use to interact with Curve Finance to Koinly to import all your trades safely and securely

Koinly identifies the cost basis of all your coins and tokens (including ERC-20 tokens), as well as your taxable transactions.

Koinly calculates any capital gains, losses, and income from your taxable transactions.

Koinly generates your crypto tax report - ready to help you file with your tax office, or hand it over to your accountant.

How to import Curve Finance transactions to Koinly automatically

To import your Curve Finance transactions, you'll need to connect each wallet you use with Curve Finance to Koinly. This is easy to do, you just need your public address - and we have steps on how to get your public address for all the most popular wallets on our integration pages.

As Curve Finance supports many blockchains, this may mean getting multiple public addresses from each wallet to ensure you're importing your transactions from all blockchains. Here’s an example of how it generally works.

On wallet

Open or log in to your wallet

Select the blockchain you’d like to connect to - for example, Ethereum or Avalanche

Copy your public address

On Koinly

Sign up or log in to your Koinly account and go to the wallets page

Search for and select the blockchain you’d like to connect to - for example, Ethereum or Avalanche

Give your wallet a name - for example - Trezor or Coinbase Wallet

Paste your public address

Select import

Want to learn how your Curve Finance transactions are taxed? Find out more in our Curve Finance tax guide.

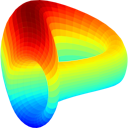

What is Curve Finance?

Curve Finance is an automated market maker - similar to other popular Ethereum vexes like Uniswap - but what sets it apart is Curve allows for liquidity pools made up of more than two pairs, provided those assets behave in a similar manner. For example, you could have a liquidity pool with multiple stablecoins in it, or multiple versions of wrapped Bitcoin. This means users benefit from lower slippage, lower fees, and a reduced risk of impermanent loss.

How does it work?

Curve Finance works in a similar fashion to other automated market makers. The protocol utilizes liquidity pools instead of arranging trades between buyers and sellers using an order book.

Anyone, anywhere can use Curve to trade tokens, as well as opt to provide liquidity to earn a share of the fees relating to that pool. CRV token

As well as this, liquidity providers may earn additional rewards in the form of CRV tokens - Curve Finance’s governance token. Many users go on to stake these on yield farming platforms like Yearn Finance in order to multiply their rewards.

How to use Curve Finance?

It's easy to use Curve Finance - all you need is a non-custodial wallet. Curve supports:

Coinbase Wallet

Trezor

Ledger

Phantom

A huge number of other wallets using WalletConnect

Once you've got your wallet funded, all you need to do is connect to Curve and you'll be able to trade, add liquidity, and more.

What can you do on Curve Finance?

You can use Curve Finance to:

Trade tokens on 11 different blockchains

Provide liquidity in order to earn fees and other rewards like CRV tokens

Vote on proposals for the protocol using CRV tokens