Crypto Staking Taxes: The Complete Guide

Crypto staking lets investors earn income in the form of crypto in exchange for processing and validating transactions on a given blockchain. But these staking rewards may give you a surprise when it comes to your taxes. Learn everything you need to know about crypto staking and crypto staking taxes in our guide.

What is crypto staking?

The amount of energy used to run mining equipment.

The resources needed to build mining equipment are needed for other industries like healthcare, IT, and the automotive industry.

Mathematical limits on scalability.

Slow transaction speeds and expensive fees.

Increased competition in proof-of-work blockchains has led to lower rewards.

So what's the alternative?

Enter Proof of Stake (PoS).

Instead of PoW, some cryptocurrencies used a PoS consensus mechanism. Some popular examples of PoS blockchains include:

Ethereum (ETH) - as of September 15, 2022.

Cosmos (ATOM).

Cardano (ADA).

Avalanche (AVAX).

Polkadot (DOT).

Solana (SOL).

Tezos (XTZ).

In a PoS consensus mechanism, you ‘stake’ your crypto to earn a reward. Staking serves a similar function to mining - a network participant gets selected to add the latest batch of transactions to the blockchain and earn crypto in exchange. The network chooses validators based on the size of their stake and the length of time they’ve held it - so the most invested participants are rewarded.

Staking through PoS helps secure the blockchain - by staking you are part of the process of creating new tokens.

Read next: the best crypto coins to stake in 2024

How do you stake?

There are four main ways to stake:

Running a validator node

Delegating using a non-custodial wallet

DeFi staking protocols

Centralized staking products

This is easiest to understand with examples - so we'll use Ethereum as an example.

With Ethereum, you can solo stake as a validator - if you have 32ETH and the right software and hardware. Alternatively, you can delegate your ETH to a validator node using a non-custodial Ethereum wallet. You can also use a decentralized staking protocol like Lido or Rocket Pool. Finally, you can stake using a centralized exchange like Binance or Coinbase.

The way you stake matters because in some countries - how staking rewards are taxed depends on whether you're staking directly as part of PoS mechanism, or if you're staking through a third party.

Read next: the best staking platforms in 2024

What is a staking reward?

It's like buying a raffle ticket with crypto. A winner is picked to validate each new block - and paid a reward. The more raffle tickets, the more you might win.

Most of the time when you stake crypto - you'll be rewarded with new coins or tokens of the same currency. For example, Tezos stakers are paid staking rewards in XTZ, Avalanche takers are paid staking rewards in AVAX, and so on.

What is a staking pool?

A staking pool is when a group of coin holders merge their resources. This consolidation can then allow them to increase their chances of validating blocks and receiving rewards in return. They essentially pool their sources and share in the rewards.

Typically, a staking pool is managed by a pool operator and the stakeholders that decide to join the pool have to lock their coins in a specific blockchain address (or wallet). While some pools require users to stake their coins with a third party, there are many other alternatives that allow stakeholders to contribute with their staking power while still holding their coins in a personal wallet.

Some of the best staking pools include:

Stakely: Validator node provider offering multiple cryptocurrencies to stake

Lido: Liquid staking DeFi protocol for ETH, MATIC, and SOL

Allnodes: Non-custodial, node-as-a-service platform

PoS staking vs. DeFi staking

To add some confusion, the phrase staking can actually refer to two different events - staking as part of a consensus mechanism like above or DeFi staking. The distinction between the two matters because it has different tax implications.

DeFi staking refers to locking your coins or tokens in a given DeFi protocol - like a liquidity pool or lending protocol - in order to earn rewards. We can liken DeFi staking to a typical lending arrangement where you provide capital in return for interest. The tax implications when it comes to DeFi staking all come down to how that specific protocol works - but Capital Gains Tax or Income Tax may apply. You can learn more in our DeFi tax guide.

For now, let's focus on staking as part of a consensus mechanism.

How is crypto staking taxed?

There are a couple of different transactions involved in staking - which matter because it's the specific transaction that dictates how you're crypto is taxed, as well as where you live.

In most instances, moving your coins or tokens around to a staking pool, wallet or third-party staking service is not going to be a taxable event. This can be seen as transferring your own crypto from one wallet to another - which is a tax free event unless you receive tokens in return in which case it could potentially be viewed as a crypto to crypto trade. Gas fees or transfer fees on the other hand have different tax implications.

However, the news isn't quite as great when it comes to staking rewards tax.

Are staking rewards taxable?

It's a murky issue, but in general, staking rewards are subject to Income Tax based on the fair market value of the coins at the point you receive them. You'll also pay Capital Gains Tax when you dispose of your staked coins by selling, trading, or spending them - like you would with any other crypto.

How to calculate staking rewards

Before you can pay tax, you need to know how much you need to pay tax on. Calculating staking rewards is easy (although time-consuming). You need to identify the fair market value of your staking rewards on the day you received them in your fiat currency. So for example, if you earn 0.2 ETH a month from staking and you live in the US, you'll need to identify the fair market value of 0.2 ETH in USD on each date you received ETH throughout the financial year. You'll then tally this up, and this is the amount you'll pay Income Tax on.

Let's take a look at how a variety of countries handle taxes on crypto staking rewards and how to calculate staking rewards...

Crypto staking taxes USA

The IRS updated its guidance in July 2023 to clarify the tax treatment of staking rewards. The updated guidance is clear that staking rewards are taxable income when received and taxed as such.

The guidance also clarifies the meaning of received, which is important for ETH stakers. The guidance clarifies that 'when received' in this instance means when the taxpayer has 'dominion and control' over the assets - so for ETH stakers this means when the rewards were unlocked and stakers were able to sell their rewards following the blockchain upgrade.

The ongoing court case of the IRS vs. Jarretts continues independently to this. You can keep up to date in our IRS staking court case blog.

Need to know more about how cryptocurrency is taxed in the US? Read our US crypto tax guide.

Crypto staking tax Canada

The Canadian Revenue Agency has not released specific guidance for staking taxes. Because staking is similar in nature to mining crypto, the safest approach is to treat received coins from staking in a similar fashion to mining.

Like with mining, the crypto you receive from staking will have different tax treatments depending on whether the activity is simply a hobby that you undertake sporadically or a business activity. This is decided on a case-by-case basis. All this said, as the CRA has focused mainly on intent when distinguishing between income and capital assets, staking may be more likely to be considered income as for many investors the intent is not to acquire more assets (coins), but to make a profit. If this is the case, you'd pay Income Tax upon receipt based on the fair market value in CAD of your staking rewards on the day you receive them, as well as Capital Gains Tax when you dispose of your crypto.

This said, if the CRA views your staking activities as a hobby the crypto you earned will be considered as an asset and you will have to pay Capital Gains Tax (CGT) when you dispose of the crypto. However, the cost basis here would be zero because no money was spent on acquiring the crypto. No deductions are allowable in this scenario.

Need to know more about how cryptocurrency is taxed in Canada? Read our Canada crypto tax guide.

Crypto staking tax UK

HMRC’s tax advice treats staking much the same as income from crypto mining. Any taxes applied to staking activities will be determined by whether or not the staking “amounts to a taxable trade.” This, in turn, is determined by several factors that include the nature of the organisation, and the commercial nature of the activity. That is if you're staking as an individual, or as a business.

If staking isn’t determined to be amenable to a taxable trade, the pound sterling value of staking awards will be taxed as miscellaneous income. Capital Gains Tax will be applicable upon disposal. In other words for most investors, you'll generally pay Income Tax upon receipt and Capital Gains Tax upon disposal in the UK for staking rewards.

Need to know more about how cryptocurrency is taxed in the UK? Read our UK crypto tax guide.

Crypto staking tax Australia

The ATO has indicated that the Australian dollar value of rewards received by staking will be taxed as ordinary income at the time of receipt. The same treatment will also apply to any other form of coin reward that is derived by a taxpayer as a result of contributing to a consensus mechanism, as well as rewards received from staking by proxy or allowing a third-party service to stake an individual’s coins on their behalf.

This approach aligns with long-standing principles of tax law in respect of the derivation of ordinary income, i.e. the receipt of a reward for the provision of services. In the context of cryptocurrencies, validators (forgers) are essentially receiving a reward for their services to the relevant network in the eyes of the ATO. Capital Gains Tax will also be applicable upon disposal.

Need to know more about how cryptocurrency is taxed in Australia? Read our Australia crypto tax guide.

Staking directly vs. staking third party

An important note when it comes to staking taxes is that some countries - like Austria - say the distinction between staking directly and staking via a third party is important and dictates the subsequent taxation. If you're staking directly - like with a Yoroi wallet - staking rewards would be tax free upon receipt. Whereas if you're staking through a third party - like Kraken - staking rewards would be subject to Income Tax upon receipt.

How to report crypto staking rewards on taxes

Want to know how to report crypto rewards on your taxes? It depends on where you live - but generally, you'll report staking rewards as additional income in your annual tax return and pay Income Tax on it. The precise forms will obviously vary from country to country, but a crypto tax app like Koinly can help you generate the forms you need easily and calculate your income from staking!

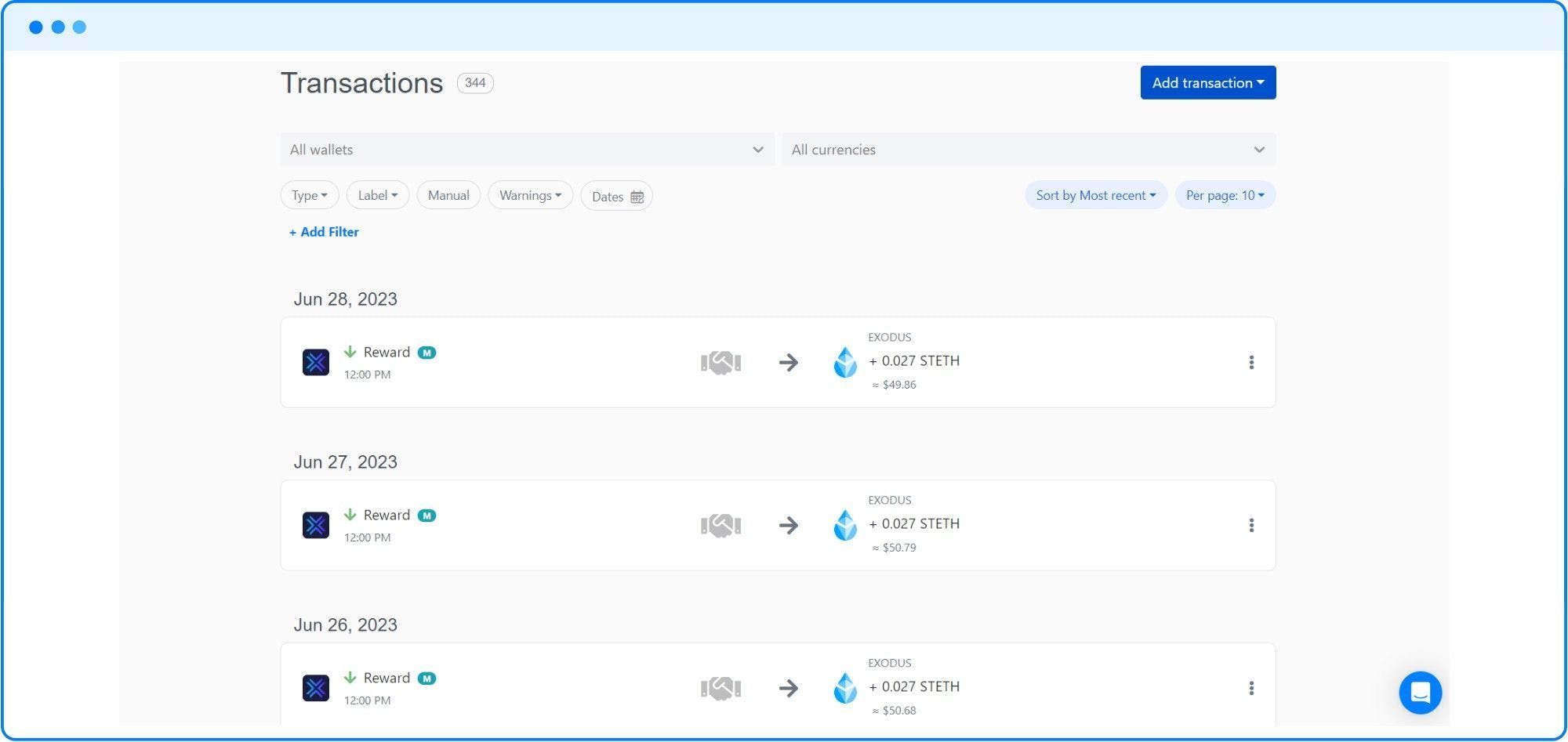

It's easy to track and tag your staking transactions with a crypto tax calculator like Koinly with automatic and manual tagging of staking rewards.

In most instances, Koinly is pretty smart and will automatically recognize and tag staking transactions. But don't worry if not, you can also manually tag your transactions to get a perfectly accurate tax report.

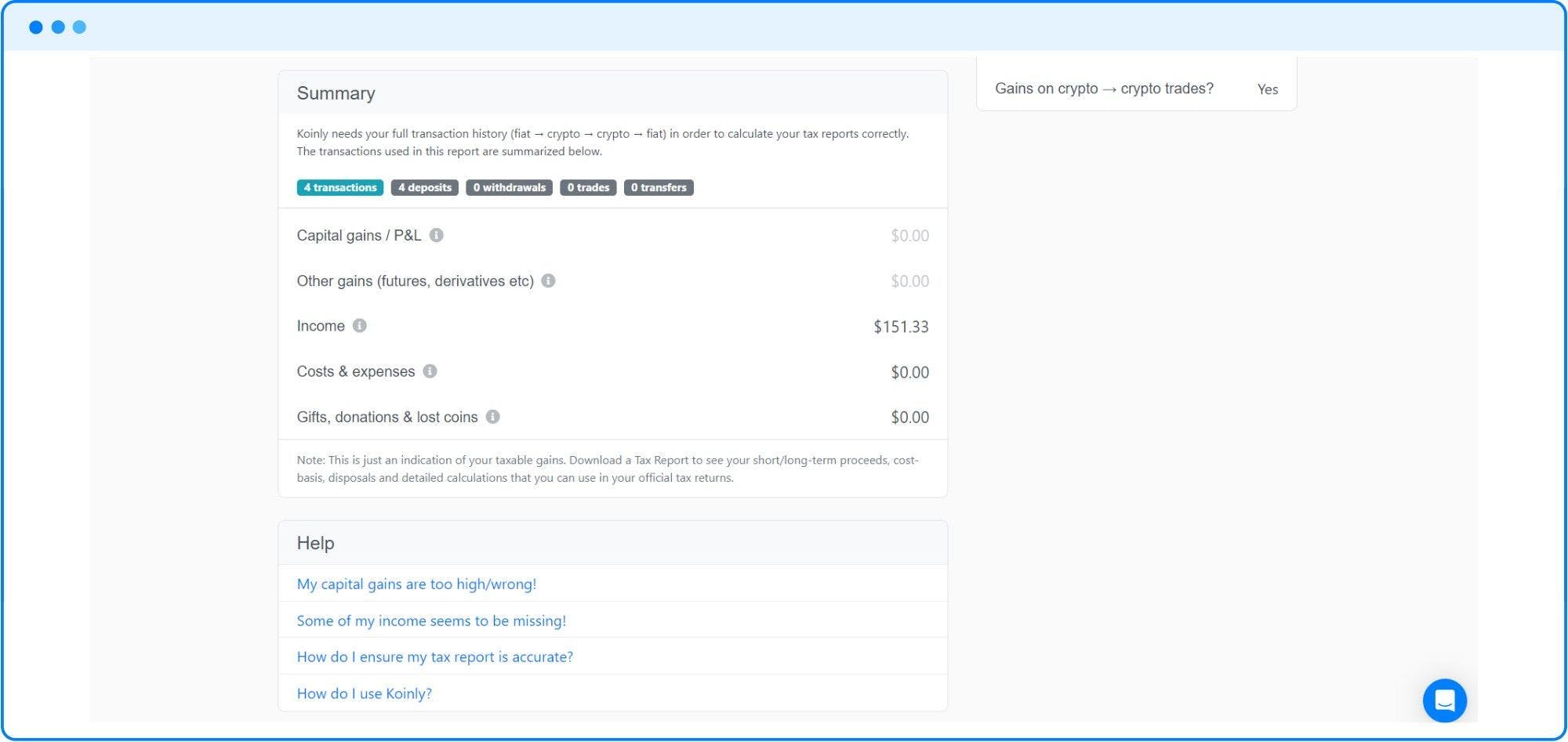

Once Koinly has calculated the fair market value of your staking rewards in your chosen fiat currency, you can simply download the report you need and file it with your tax office. You can even see a preview of your taxable income from crypto in your tax summary.

Once Koinly has calculated the fair market value of your staking rewards in your chosen fiat currency, you can simply download the report you need and file it with your tax office. You can even see a preview of your taxable income from crypto in your tax summary.

Koinly generates a variety of reports based on your location and your tax office. Once you've downloaded your report, simply hand it over to your accountant or use the figures in your report to file your preferred way.

Koinly generates a variety of reports based on your location and your tax office. Once you've downloaded your report, simply hand it over to your accountant or use the figures in your report to file your preferred way.

Learn more about how staking works in Koinly in our help guide.

FAQs

More burning questions? We got you.

Do I have to pay tax if I sell my staking rewards?

Yes. Selling crypto - including staking rewards - is a disposal of an asset and any gain is subject to Capital Gains Tax. You'll use the fair market value of your staking rewards at the point you receive them as your cost basis.

When should I recognize income from my staking rewards?

You need to recognize income at the "time of receipt" - but this point isn't always clear with staking rewards as to whether you should recognize rewards when you've earned them or when you've withdrawn them. The conservative approach to this is to assume that as you have the ability to withdraw your staking rewards, rewards are income as soon as you receive them.

What about tax on ETH 2.0 staking rewards I can't withdraw?

The IRS has no official guidance on the taxation of staking rewards that cannot yet be withdrawn, but some investors are arguing that where withdrawals of staking rewards are restricted, for example, ETH 2.0 staking rewards, they should not pay tax on this. There are some merits to this argument, but the conservative approach is to report all staking rewards as income regardless of whether you withdraw them immediately. If you're unsure or want to take a more aggressive approach, you should speak to an experienced crypto accountant for advice. Now you can officially withdraw staked ETH following the Shapella upgrade, generally speaking, you'll need to report your staking rewards as ordinary income based on the fair market value on the day you withdrew them in your fiat currency.

Is staking equipment tax deductible?

This all depends on how you're viewed, but if you're seen to be operating a business in the course of your staking activities, you would be able to deduct this from your taxes.

Which IRS form do I report staking rewards on?

This depends on your employment status. Salaried employees should report income from staking rewards as "other income" on Form 1040 Schedule 1, while self-employed taxpayers should use Schedule C.

What is dominion and control and what does it mean for staking taxes?

Dominion and control is a concept that relates to ownership. For staking, this matters, because in many instances, investors don't have the ability to freely withdraw their rewards. As such, there is an argument that investors do not have dominion and control over their rewards until such a time as they can freely sell or trade their rewards.

Can I deduct staking equipment?

It depends on where you live, but individual taxpayers generally cannot deduct staking equipment costs. However, if you've bought validator equipment as part of business activities, you may be able to deduct staking equipment costs as an expense.

TLDR;

Staking crypto means locking your crypto up in a kind of contract or pool in order to earn a reward.

Your staking contribution should earn you a staking reward.

Staking rewards are paid to you in cryptocurrency.

This is similar to earning interest or being paid a dividend.

Staking rewards are generally viewed as additional income and subject to Income Tax in most countries.

You'll also pay Capital Gains Tax on any gain if you later sell, swap, or spend your staking rewards.